Whether you are small business owner, entrepreneur or a freelancer, you cannot deny the fact that time and money are your precious resources. As a small business owner, you may be spending a lot of time managing money. There is always some work involving sending invoices, paying bills, account reconciliation etc.

When it comes to choosing the best accounting software, FreshBooks, QuickBooks, Xero, and Zip Books are the most popular ones available in the market. In this article, we are going to look at FreshBooks vs QuickBooks vs Xero and see which one is best for your business.

What to Look for in an Accounting Software?

Accounting software not only saves a lot of time and effort but also reduces human errors and provides timely reports. Previously, it took more than 2-3 days for the accounting personnel to get the monthly reconciliation, invoice, and expense closing for the month. But with the advent of accounting software, everything can be completed within a day.

Some of the common features that you can expect from an accounting software are:

- Quotes and Estimates

Option to send quotes and estimates to customers and the ability to convert the quote into an invoice easily once the customer accepts the quote

- Invoicing

Option to create and send customized invoices to your customers easily and quickly. Tracking overdue invoices is one the areas where accounting personnel spend a lot of time. The accounting software should automatically provide a list of all overdue invoices and paid ones.

- Bills and Expenses

Option to easily capture all your company expenses including recurring and one-off expenses etc.

- Time Tracking

Option to track the time spend on various tasks to send hourly rates in your invoices

- Reconciliation

Easily reconcile your bank account with your transactions including payments, expenses and invoices etc.

FreshBooks Vs QuickBooks Vs Xero

Let’s see a quick introduction to all this three-accounting software below:

FreshBooks

When it comes to accounting software, FreshBooks is a new entrant in the industry. Their target group is small business owners and internet-based services. FreshBooks cannot be called a complete accounting package as they don’t provide loan amortization and inventory control. But it has everything needed to fulfill the accounting requirements of a small business.

It is packed with all the necessary features like invoice reminders to collecting payments, you can easily put your accounting tasks to autopilot mode and spend your time in growing your business.

QuickBooks

QuickBooks is a popular accounting software and one of the most widely software in the industry. It is a complete package that offers all the features that you look for in a financial software.

QuickBooks offers an extremely easy-to-use interface and is best suited for small and medium sized businesses. Quickbooks is available as both an on-premises accounting solution as well as a cloud-based version.

Xero

Xero is an online cloud-based accounting software that will help you to grow your business. It offers every feature including payroll, inventory management, project management and approval workflow etc.

If you are running a company that is looking to grow into a larger company in the next few years, then Xero is the best option for you. It offers various integration options to fulfill all your accounting requirements.

FreshBooks Vs QuickBooks Vs Xero – Feature Comparison

All three-accounting software including FreshBooks, QuickBooks, and Xero offer all the basic features that you will expect in a financial software. But yet, they are different from each other in how each functionality is implemented. Let’s compare this software packages with some major features as outlined below:

Pricing

FreshBooks: FreshBooks offers three levels of pricing based on the number of billable clients. The plans include:

- Lite – $6/month (5 clients)

- Plus – $10/month (50 clients)

- Premium – $20/month (Unlimited clients)

If you need some customized features, then you can opt for custom pricing plan which offers access to a dedicated manager. FreshBooks also offer a 30-day free trial.

QuickBooks: QuickBooks on the other hand offers four types of plans for small businesses including:

- Simple Start – $12/month

- Essentials – $20/month (3 users)

- Plus – $35/month (5 users)

- Advanced – $75/month (25 users)

They also offer a plan for self-employed freelancers that allows them track income and expenses, capture receipts, invoices and accept payments for $7/month.

Xero: Xero offers three pricing plans for accounting professionals:

- Starter – $20/month

- Standard – $30/month

- Premium – $40/month

All three packages cover all the basic accounting functionalities, but with the Premium plan, you can work with multiple currencies, which is not available with the other two plans.

Ease of Setup

FreshBooks: When it comes to installing and setting up the FreshBooks accounting software, you’ll find it extremely easy and straightforward. In just a few minutes, you can get started with your accounting work.

Once you install the software, you can easily import all your existing data including your clients, expenses, products and services, taxes etc. If you are switching from another accounting software, you need to export your existing data from that software into XL or CSV format to get it imported into your new software.

QuickBooks: The setup process is with QuickBooks quite friendly like FreshBooks. Here you get an easy to setup wizard that guides you through the installation process. All you need to do is complete the tasks provided or answer the questions asked in each step and your installation will be over in just a couple of minutes.

Xero: When comparing with QuickBooks and FreshBooks, Xero offers more functionality and hence the setup process is a bit complicated. But the setup wizard makes things easy.

Importing your existing data is quite simple with Xero as you can import all your customers and invoices in just a couple of minutes.

Invoicing and Payments

One of the prime functionalities of an accounting software is to provide option to create invoices easily.

FreshBooks: The invoices and payments options offered in FreshBooks is pretty streamlined and straightforward. Even though there are not many options available in FreshBooks like the ones available in Xero or QuickBooks, this is enough for a small business.

The invoice screen provides a small business owner with a clean overview of all the pending and completed invoices. FreshBooks also provides notifications mails and you even have the option to customize the text of those emails too.

QuickBooks: If you are running a brick-and-mortar store, then the QuickBooks’ mobile card readers will be of great help to your business. sell products at a brick-and-mortar location, QuickBooks’ mobile card readers will help you avoid looking for a separate payment service.

When you opt for GoPayment service from QuickBooks, you’ll be provided with a Quickbooks Card reader for free. But if you want a reader that is compatible with Android, iOS and Samsung Pay, then it will cost you around $49.

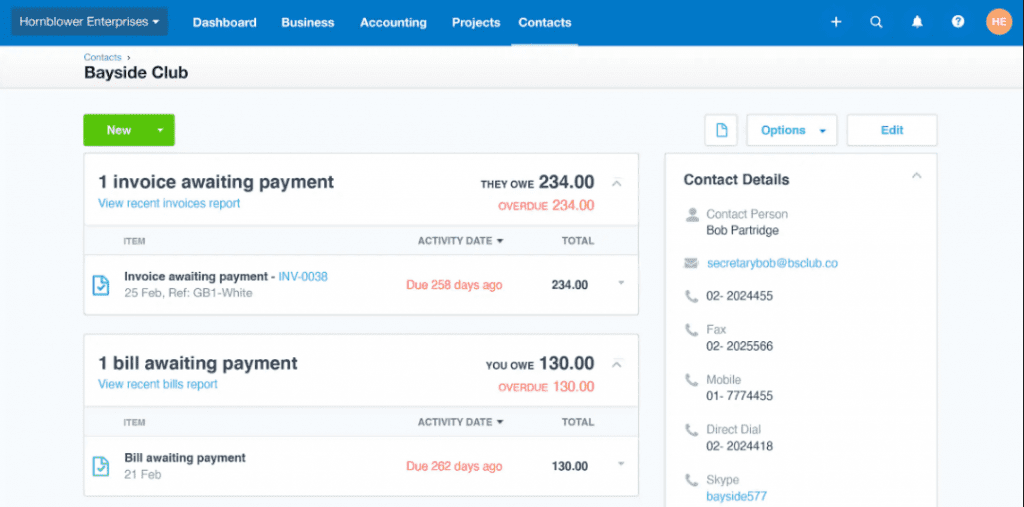

Xero: When it comes to invoicing and payments, Xero is the go-to solution, as it offers a great set of customization features, With Xero, you can design your own invoice and integrate with your inventory management system.

Approval workflow is another unique feature offered by Xero, where you can customize the software for approving the invoices before it is sent. This is largely helpful in large companies where various departments generates invoices and need to be approved by a manager.

Reporting

Effective reporting provides any business to get an overview of their financial health at all times.

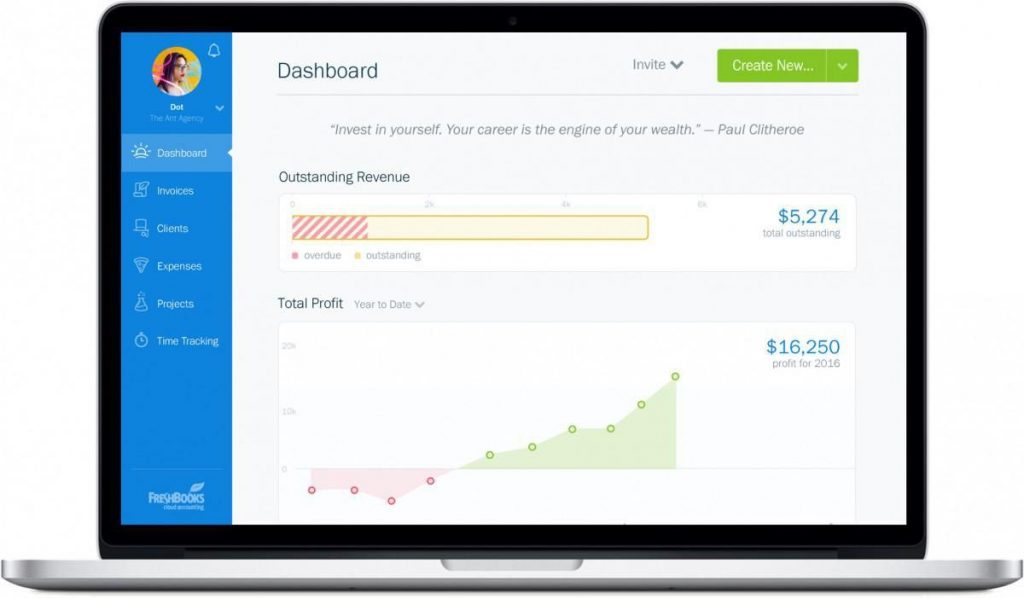

FreshBooks: The reporting features provided by FreshBooks is quite simple and straightforward. The dashboard comes loaded with five type of graphical displays including outstanding revenue, total profit, revenue streams, spending, and unbilled time.

Apart from that you can run all kind of accounting reports including profit/loss, tax summary, accounting aging, invoice details, expense report etc.

QuickBooks: Quickbooks offers all the standard reporting features you would expect in an accounting software including invoices overdue, expenses report, profit/loss, sales report, bank reconciliation, payroll etc. Quickbooks also allows you to create custom reports.

Xero: The reporting dashboard in Xero looks similar to that of Quickbooks as you can easily view all the pending bills, invoices, expenses, cashflow.

Xero is specially designed for large enterprise, hence, you get a Business Performance dashboard, that allows you generate debt ratio report, current liabilities and gross profit percentage etc.

Final Thoughts

Accounting software helps business owners to get an overall view of the financial performance of their business. But choosing the best software that suits their business needs may be a bit tricky. Hence, we came up with this article to help you decide the best accounting software for your business.

Overall, all the three-software reviewed above are the most popular and widely used software across the world. Yet each one comes with their own set of unique features and their own pricing plans.

While FreshBooks and QuickBooks is better suited for small businesses, Xero is the best option if you are running a large business. But all three software provide integration options to help you take advantage of business process automation. Moreover, there is free trial offered with all the software, hence, it is better to try out each service, before finalizing one that suits your requirements.

Please feel free to provide your comments and suggestions in the feedback section below!!!